prince william county real estate tax payments

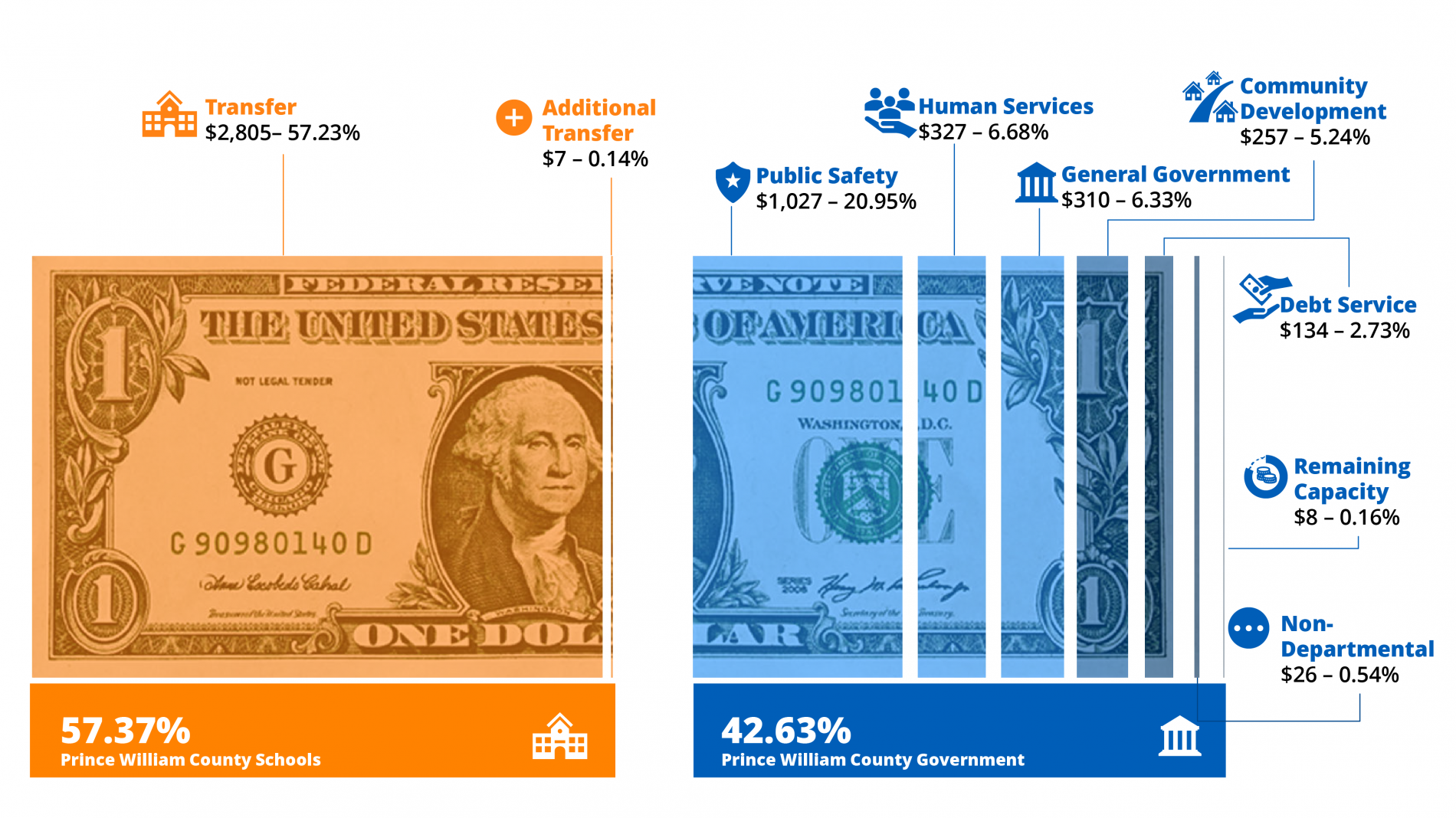

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. 2019 Tax Rates PDF download.

Real Estate Taxes Due Prince William County Mdash Nextdoor Nextdoor

2018 Tax Rates PDF download.

. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. 2016 Tax Rates PDF download. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

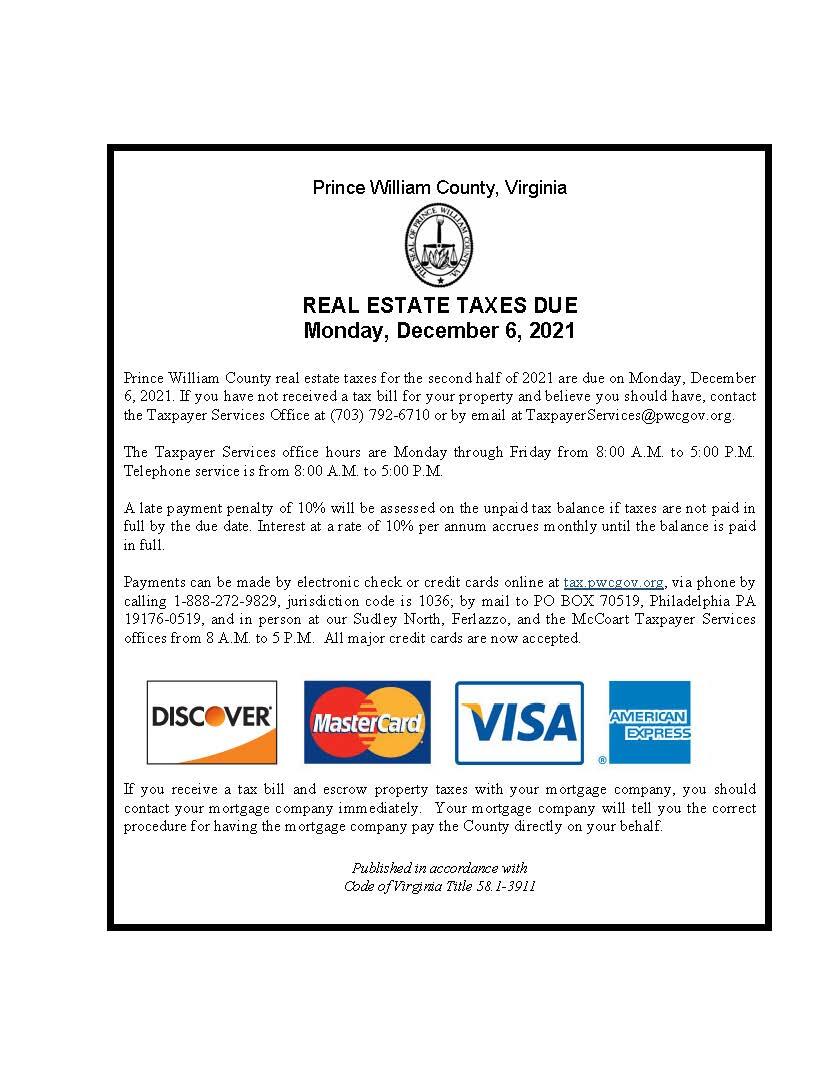

1-888-272-9829 enter code 1036. 2017 Tax Rates PDF download. Perform a free Prince William County VA public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real.

2014 Tax Rates PDF. During a meeting on Nov. You can pay a bill without logging in using this screen.

Prince William Board of Supervisors extends real estate tax payment due date to October 15. 1 be equal and uniform 2 be based on up-to. To make matters worse for residential.

Payment by e-check is a free service. The system will verbally. Teléfono 1-800-487-4567 entrando código 1036.

Make a Quick Payment. How The Payment Process Works. All you need is your tax account number and your checkbook or credit card.

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Citizens and businesses struggling to pay real estate taxes during the coronavirus. Taxation of real property must.

The citys carrying out of real estate taxation cannot infringe on the states constitutional regulations. The Tax counters at both the McCoart Building 1 County complex Court and the Sudley North Building 7987 Ashton Avenue will remain open to serve you. Prince William County collects on average 09 of a.

If you have not received a tax bill for your property and believe you should have. In Prince William County Virginia the tax rate is 105 which is substantially above the state average. When making a payment online or by telephone you will need the eight-digit Tax Account number for the account youre paying.

2015 Tax Rates PDF download. Tax inquiries may be made by calling 703-792-6710 or by email. Personal Property The Town of Visit Prince William County.

The County works directly with ACI. Tax payments can also be made. A convenience fee is added to payments by credit or debit card.

This estimation determines how much youll pay. By creating an account you will have access to balance and account information notifications etc. Taxes are paid using one of the options.

Due to the low tax rate.

Prince William County Taxpayers Shocked By High Personal Property Tax Bill

Data Center Development Spurs More Debate In Prince William County Data Center Frontier

Ntt To Develop 336 Mw Gainesville Virginia Data Center Campus Dgtl Infra

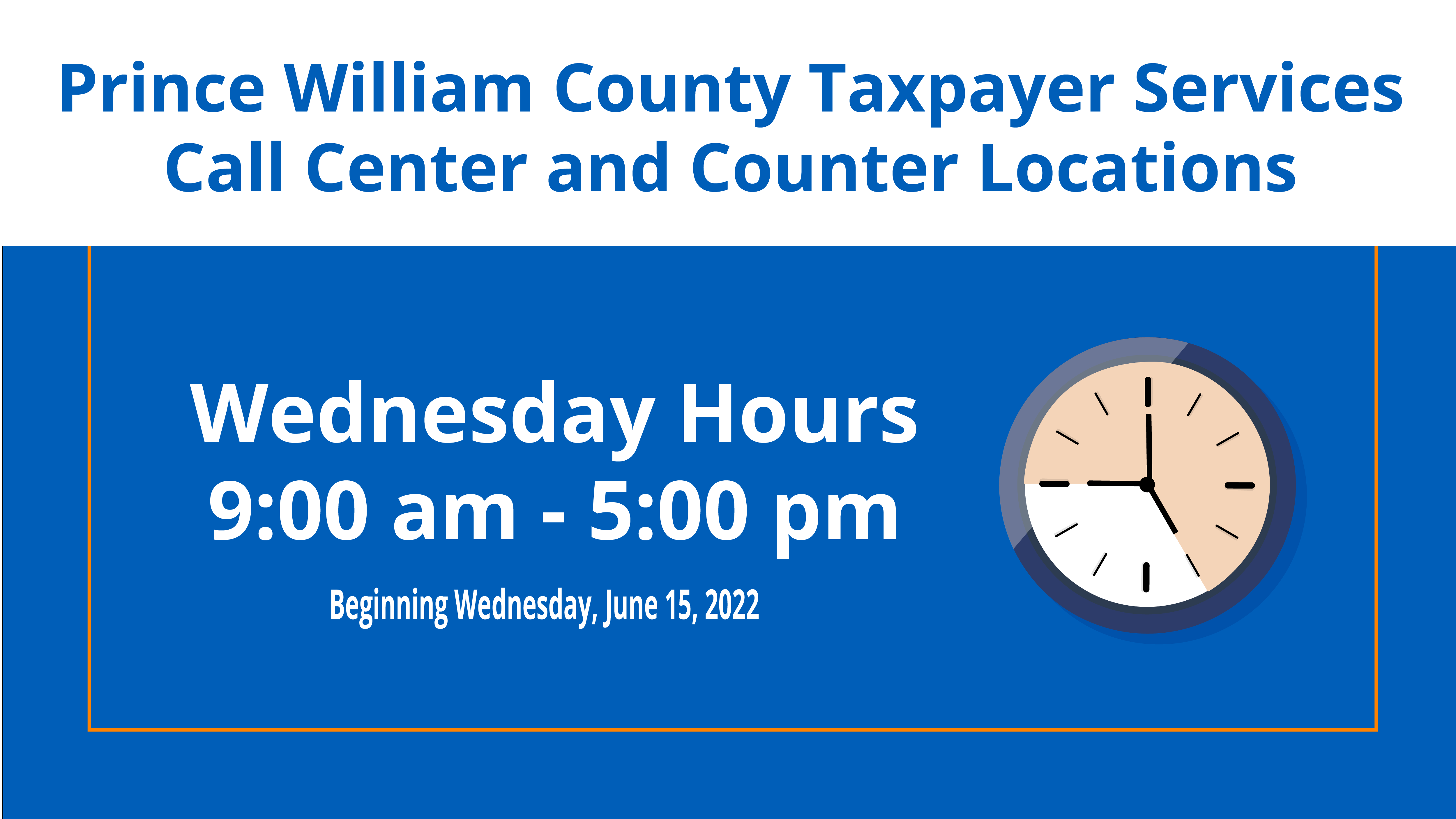

New Hours For Taxpayer Services Call Center And Counter Locations

The Sheriff Of Nottingham In Prince William County

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax

Prince William County Va Businesses For Sale Bizbuysell

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Headlines Insidenova Com

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Wtop News

Personal Property Tax Rate Drop Could Help Offset Rising Real Estate Tax Bills Vehicle Values News Fauquier Com

Washington Commanders Move To Buy Woodbridge Site For New 3 Billion Stadium Complex News Princewilliamtimes Com

Prince William County Property Management Prince William County Property Managers Prince William County Va Property Management Companies

Manassas City Council Votes To Decrease Personal Property Tax Bills

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax